Did you apply for 2021FY Rent deductions?

I still got emails for this subject, you can apply for Rent deductions if you paid it by yourself. Actually you can apply for the...

Deductions for Monthly Rent

From 2021FY, NTS decide that you foreigners can claim this deductions from your salary income during your year-end settlement process....

Year-end Tax Settlement Schedule

if you're a salary incomer, sooner or later from Jan. 15, 2019, you guys can download all of deductible items from the Hometax(홈택스:...

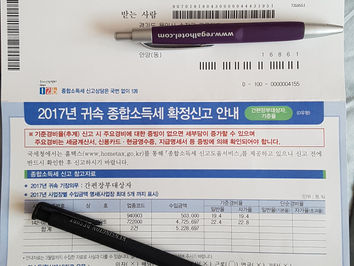

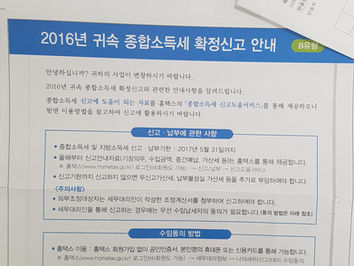

Global Income Tax Return

I think you may get this NTS letter recently and need to prepare return and pay taxes by the end of May. Most of salaried employee who...

Housing Allowance

Is Housing allowance taxable income? Even if an employer didn't pay it added on a monthly salary? If your employer pay it added on your...

Year-end tax settlement(연말정산)

2017 Year-end tax settlement data at the Hometax will be ready from Jan.15, and you can download all of deductible items there and submit...

Payroll Service in Korea

Jz provide the payroll service for employees who hired in Korea for your operation. Your company is not necessarily established already...

Individual Income Tax Return(종합소득세)

expat tax return in korea

Tax Receipts: 근로소득 원천징수영수증

Now you got the tax receipts as below from your employer, then you're not a contractor or 3.3% tax payer, and this is your turn to review...